In our recent article on Climate Change, we referred to ‘mitigation’ as one solution to slow, then halt, the accelerating changes in our environment. Part of mitigation is the replacement of carbon releasing energy sources by ‘clean’ renewable sources. We review the progress of renewable energy generation and the work still to be done. The article focuses on Electricity generation with comments concerning transport and heat generation.

The Challenge gets bigger for renewable energy

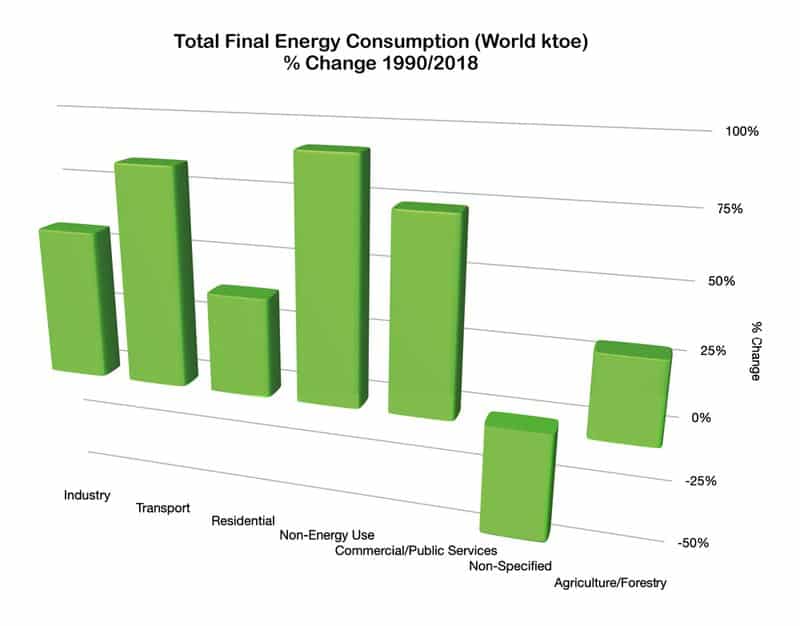

A view of the tables below shows that our consumption of energy has grown significantly in the last thirty years or so. This is not just a population effect. The International Energy Agency (IEA) data also shows energy usage per capita increasing.

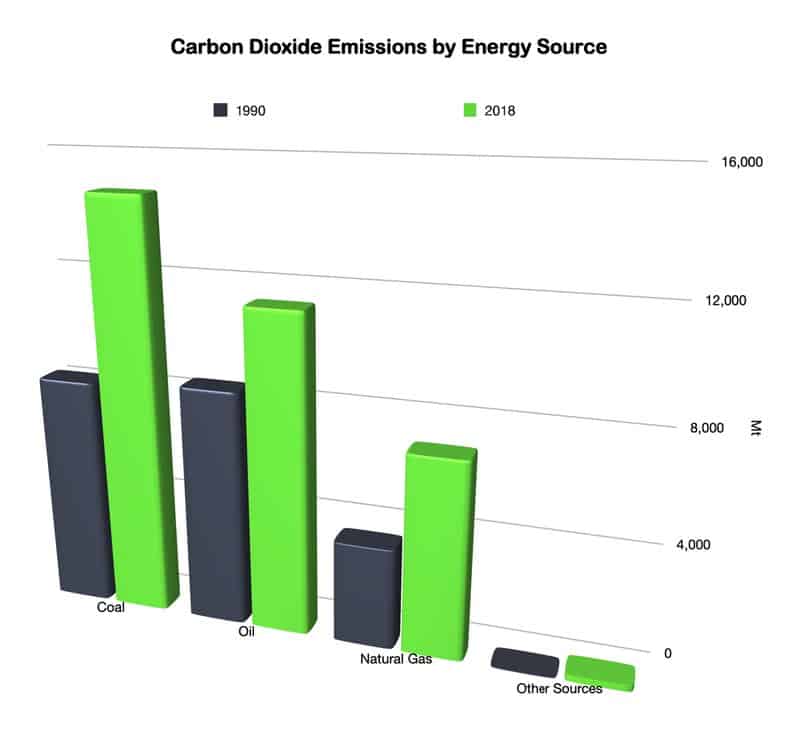

This, of course, has a knock-on effect for Carbon Dioxide emissions.

Despite our awareness of the negative impact on Global Warming, Carbon Dioxide emissions have risen 63% since 1990. It is against this backdrop that we must review progress on the deployment of renewables.

The Global Perspective

Electricity Generation Renewable Have A Long Way To Go

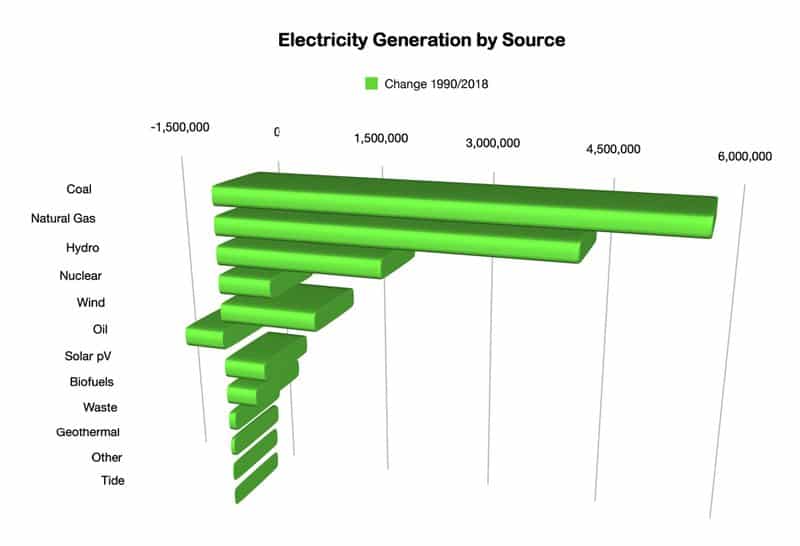

The table below shows the growth in the generation of electricity by the source from 1990 to 2018. Renewable energy use has increased from 20% in 1990 to 26% in 2018. This is great. Energy generation from coal and natural gas is even greater, however. These sources represented 61% of generation in 2018. There is still a long way to go!

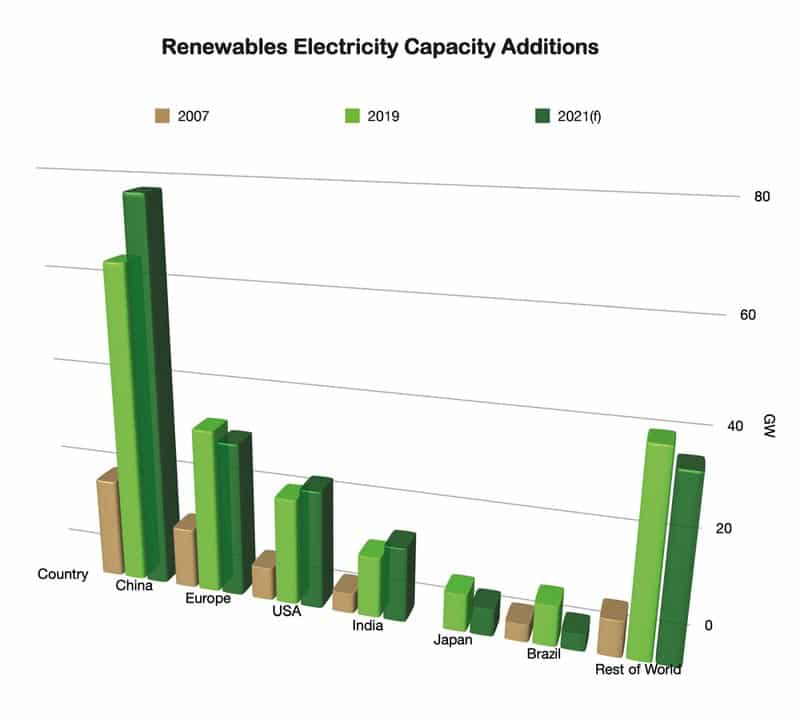

The positive news is that there is still a commitment to ongoing new renewable capacity additions. The table below shows the growth from 2007 to 2019. The Covid-19 pandemic will impact the 2021 forecast, this still shows a commitment for overall capacity growth.

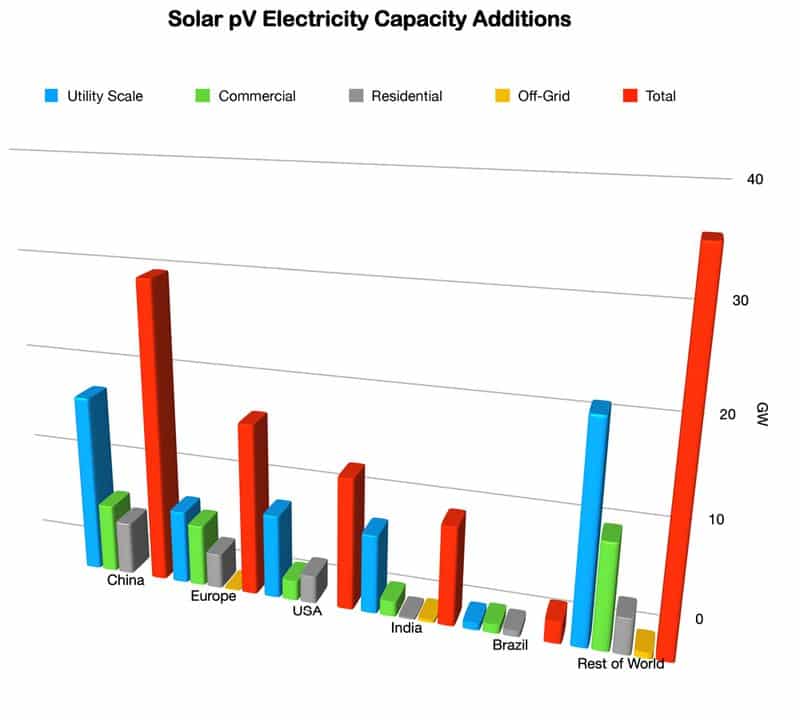

Solar pV represented 57% of 2019 capacity additions. Solar is, arguably, the lowest investment cost source of renewable energy. However, energy storage and grid flexibility will be key to its accelerated use, particularly for utility-scale installations.

Wind Power A Growing Renewable Energy Source

Wind power added a further 60GW capacity in 2019. Of this, the majority was onshore development (54GW). China led the way with an additional capacity of 26GW in 2019, a 27% increase from 2018. The USA grew capacity by around 33% to 2019 and Europe 23%. Parts for wind turbine power have a global manufacturing footprint, with hubs in China, USA, Europe and India. This contrasts to solar pV module manufacture where 70% is in China. However, despite Covid-19, manufacturing capacity outstripped installations and supply is not seen as an issue for either solar or wind generation.

13 GW of Hydropower capacity was added in 2019, a reduction from 24GW in 2018. However, 2021 forecast shows a recovery to 28GW capacity addition. In 2019, Brazil led global hydropower additions with 5GW. Global capacity in bioenergy for power increased by 8GW in 2019; this was largely driven by Chinese energy from waste products.

Transport and Heat Markets

Overall, heat accounts for half of the final energy consumption (2019). However, modern renewable energy (excluding traditional uses of biomass) meets only 10% of global heat demand. This share is increasing, but only slowly. A major reason is the lack of Countries with national targets for renewable heat. This is less than a third of those with a target for renewable electricity. Current low oil and gas prices have negatively affected the cost competitiveness of renewable heat. Here, the lack of national policies exacerbates the situation.

Global transport biofuel production reached a record 162Bn litres in 2019. This is equivalent to 2.8 million barrels per day and is ~7% year-on-year increase. However, Covid-19 has negatively impacted biofuel production growth. Oil-based fuel usage has declined due to the pandemic. The mandated levels of biofuel mix allowed result in an identical trend. Again, national policies must change to stimulate accelerated growth of biofuel usage.

The view beyond 2021 For Renewable Energy

Covid-19 casts great uncertainty on near term renewables growth. However, this uncertainty applies across the whole economy. In most countries, renewables (particularly onshore wind and solar PV) are the cheapest way of meeting growing electricity demand. Governments have had to pump massive amounts of money into their economies to offset the effects of the pandemic. The cost benefits of renewable should result in a reinforcement of policies for ‘green’ investment to support economic redevelopment and job creation. Looking at the project pipeline out to 2025, the indications are that projects will be extended or delayed, but not cancelled.

The situation for growth in transport biofuels is more fragile. A likely sustained low oil price makes biofuel less attractive and strong national policies are required to drive renewable growth. The same is also true for heat markets, where national policies are required to drive renewables growth.

Closer to home – the UK perspective

Overview

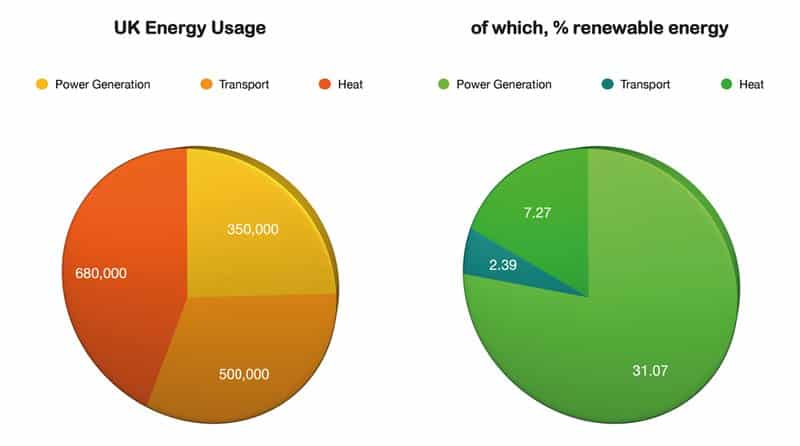

The Association for Renewable Energy and Clean Technologies (REA) published the following 2018 data. In the following commentary, it should be noted that the report was issued before the Covid-19 pandemic.

Renewable power generation tripled in the five years up to 2018. 2018 was the first year in which renewable electricity surpassed that generated by fossil fuels. This growth has continued, with almost half of the UK electricity generation being renewable in the first three months of 2020.

The 2018 data suggested that the UK was on track for its 15% Renewable Energy Directive (RED) target by 2020. However, this was due to power generation and transport and heat were below targets. Covid-19 will also have impacted these projections.

Electricity Generation

Onshore wind provided the greatest contribution to renewable electricity generation. An installed capacity of ~ 31,000 MW in 2018 grew from ~29,000 MW in 2017. However, the offshore wind gave the largest 2018/2017 capacity increase of any renewable source. From ~21,000 MW in 2017 to ~27,000 MW in 2018. The offshore wind sector deal, announced in 2019, should facilitate continued growth into the 2020s.

Solar PV has far surpassed the National Renewable Energy Action Plans (NREAP) targets. The 2020 target was set at ~2,500 MW but installed capacity reached ~13,000 MW by 2018. The significant growth from 2010 has slowed in recent years due to subsidy cuts. The Feed-in-Tariff (FiT) scheme closed in March 2019. However, the Smart Export Guarantee (SEG) came into force on 1st January 2020. This is a Government set obligation for licensed electricity suppliers to offer a tariff and make payment to small scale low-carbon generators. It applies to solar PV installations up to 5 MW exporting to the grid.

In 2018, Biomass for power also beat the NREAP 2020 projection. 2018 saw an installed capacity of ~4,400 MW versus a target of ~3,100 MW. Biomass growth has been steady since a 2009 installed capacity of ~400 MW. Other renewable sources (eg waste to energy, anaerobic digestion, tidal) have lower installed capacities which remained relatively unchanged 2017 to 2018.

Transport

Transport is the greatest source of emissions in the UK. It accounts for 33% of all carbon dioxide emissions. The UK bioethanol and biodiesel usage in 2018 were projected as ~ 1,400 ktoe. This is a growth from a level usage of ~1,000 ktoe in each of 2015, 2016 and 2017. However, it falls well short of the ~4,200 ktoe Government target for 2020 and also short of the mandatory RED target. The REA attributes this to ‘low Government ambition and target levels’. It is hoped that the 2018 Road to Zero Strategy, for transport decarbonisation, will redress the balance.

Electric Vehicles (EV) are growing into the total new vehicle registrations market but from a low base. There were 150,000 new EV registrations in 2018, representing ~6.5% of the total. Compared to the number of EV in operation, the UK has a good national charging infrastructure in place. Further, this is growing rapidly. A current significant barrier to EV growth is the supply of vehicles and batteries. However, this is likely to improve through the 2020s. The news that the Government has bought forward the banning of all diesel and petrol vehicles on the road by 10 years to 2030, will also help the stimulus towards electric vehicles. This is the second toughest worldwide target and will help in the drive for renewable energy usage and replacement of carbon-emitting vehicles.

Heat

Annual generation from biomass and solid waste boilers reached ~44,000 GWh in 2018. This already outstripped the NREAP 2020 target of ~42,000 GWh. Renewable heat production from heat pumps showed a significant jump from ~2,500 GWh in 2016 to ~11,000 GWh in 2017. Growth then slowed to remain roughly level to 2019. This leaves performance much less than the ~26,000 GWh NREAP 2020 target. Anaerobic Digestion (AD) has grown sharply from 2014 to 2018. The 2018 value of ~4,600 GWh is already above the NREAP 2020 target of 3,500 GWh.

Future Perspectives

Governmentally, the UK appears committed to the replacement of carbon dioxide creating fuels with renewable alternatives. The Smart Export Guarantee, Offshore Wind Sector Deal, Road to Zero Strategy, Green Homes Grant and the extension of Renewable Heat Incentive (RHI) to 2022 give frameworks for this. Further, the Prime Minister gave a significant intention to quadruple offshore wind supply to 40GW by 2030. However, some of these schemes may need strengthening, particularly for transport and heat, if the UK is to meet RED targets across the board.

Because of the variable nature of key electricity renewable sources, significant flexibility must be established for the National Grid. The development of higher power storage systems is also seen as pivotal to reaching zero-carbon goals in power generation.

Organisationally, the UK seems well-positioned. The REA quotes nearly 7,000 Businesses involved in renewable supply and services. Many of these are highly innovative and there is a published desire to become the ‘silicon valley’ for renewables.

Of course, the UK is dependent on global collaboration to reach its targets. As examples, the manufacture of Electric Vehicles, batteries and solar pV system componentry is largely off-shore. The government is trying to build a world centre for renewable energy manufacturing in Northumberland, including the use of technology to capture carbon and bury it underground.

Renewable Energy The Future

It cannot be emphasised enough that Climate Change is a global issue. Arguably renewable energy and carbon emission reductions are second on the agenda to So, the solutions must also be Global. ALL major economies must sign up to the Accords and take ACTION to the commitments they make. The Accords must be reviewed regularly and amended as the data dictates. Covid-19, whilst a serious issue, must be seen as a short-term ‘blip’ and contingencies put in place to bring performance against target back into line. Governments that are progressive and understand the benefit of cornering an area of the renewable energy market will reap the rewards with safeguarding jobs in their local economies.