Business data is a key asset for a Company, but how many businesses structure and analyse this asset to their advantage?

Contrary to the sentiment behind ‘analysis paralysis’, we will show that relatively simple analyses of your data should bring a focus for action in a business, resulting in many Customers purchasing more and often giving a business an improved profitability. The final blog in the series looks at procurement and supplier portfolio management.

The importance of structured procurement

This is well illustrated by a case study and relates to a business involved in the distribution of industrial consumables. The company was highly sales driven, to the point where most product specification was determined by the end Customer as relayed through the sales teams; in some cases, the sales person themselves would specify the supplier as well as the product. As a result, the business had a huge product portfolio with an extended supplier base. On entering the business and carrying out careful analysis, it was clear that exactly the same product could be supplied by several different suppliers, slight variants (that could be combined as a single product) had multiple supply lines or these variants came from a single supplier. The procurement team did a magnificent job in managing a complex supply chain but, in essence, their role was relegated to that of a sourcing agent with no time to step back and take a more strategic view. Changes in the senior leadership of the business meant this weakness was recognised and addressed. Putting a supplier strategy in place, with a resulting rationalisation of products, was a significant factor in turning the business from loss making to profitable, with very limited impact on sales.

The danger of ‘cost price only’ management

Let’s consider the following scenario: A business ‘prioritises’ it’s suppliers by the margin they make from them; by having a focus on driving down cost price, not only are they able to enjoy a high margin, but also offer most products to the market at a very competitive sell price. However, another measure shows they are losing market share. A review of their immediate competitors shows that they are using product from suppliers that had previously been rejected due to cost price; however, these higher cost price products offer greater value to end Customers in the market and are preferred. Further investigation also shows that the ‘competitive’ suppliers are very active in developing new products which are likely to change the market. Clearly, in this scenario, a focus on ‘cost price only’ is a dangerous strategy for the future well-being of the business. Further, it is proving impossible to garner interest from these alternative suppliers; they simply do not seem interested in talking to you remembering their previous experience! Other factors should be considered in developing a robust supplier strategy and most successful businesses take these into account.

Segmenting suppliers and developing a strategy

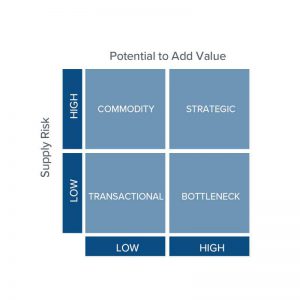

Most companies will have a significant number of suppliers and, usually, a limited number of procurement personnel. In such circumstances, no supplier would enjoy any significant time for discussion and development. This was the situation in the case study and would be the outcome of the scenario above. Segmenting the supplier base can lead to focus being given where there is greater risk and/or more opportunity. The following shows a typical matrix employed and others can be found under a search for the Kraljic matrix.

Strategic suppliers add high value to the business through, often, offering unique specifications to satisfy market needs; this makes them critical to your competitive advantage. Further, this makes the supplier very difficult to replace with no, or very few, alternative supply options. These suppliers also represent high value to you and so the risk could be considered double fold. They are likely to have a focus on development and exhibit long-term profitable growth. This segment will be small in number; Gartner illustrates this, quoting an industrial manufacturer with around 90,000 suppliers choosing 12 as strategic. Clearly, partnership relationships should be built with strategic suppliers, processes and systems developed to facilitate a highly collaborative approach. This will demand a significant percentage of procurement management time.

Commodity suppliers are those that usually have little differentiation in the product they supply, but are high risk in the level of spend and the revenue they represent to you. Here, as a commodity, the price of the product may be critical in an end users’ decision making, so managing cost of supply against a well-defined specification is likely to be critical. Continuity of supply will also be a keen consideration for the end user. Quality and service issues will be important measures.

Transactional suppliers are low in both potential to add value and the risk they represent. However, they usually represent the larger population of suppliers; traditionally, therefore, these suppliers will have demanded a significant portion of overall time for procurement personnel. Consolidation can reduce the number of suppliers and increase the cost/revenue value, pushing the supplier into the commodity box. Again, key measures should be employed to ensure supplier performance and, in essence, a ‘management by exception’ approach taken.

Bottleneck suppliers add high potential value, but represent low risk as assessed in the matrix. However, poor supply performance of, for example, a differentiated product could result in severe problems for an end-user and damage your reputation. Working with strategic suppliers to develop equivalent differentiated products can allow consolidation and mitigate some of this risk. A collaborative marketing approach to others could grow sales and elevate the supplier into the strategic category.

Apportioning time and tactics appropriately optimises the returns available to your company and gives an element of ‘future proofing’.

1. Optimise resources and achieve better results with an effective supplier segmentation strategy. Gartner 27.06.2018

Please read our other News Articles from the Pier 9 team.